Elizabeth McLaughlin, Staff

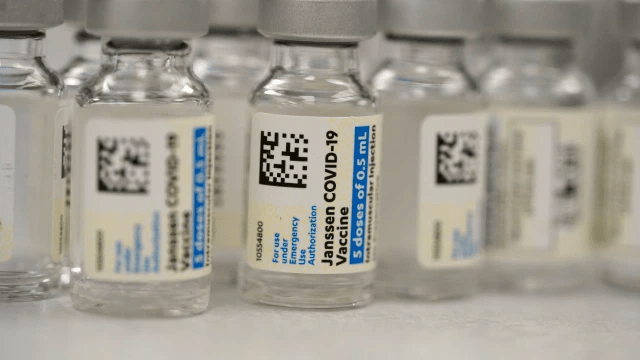

The administration of the Johnson & Johnson COVID-19 vaccine was paused due to cases of rare blood clots associated with those who received the shot.

On April 20th, Johnson & Johnson announced that the European Medicines Agency’s Pharmacovigilance Risk Assessment Committee (PRAC) reviewed the company’s vaccine and confirmed that the overall benefit-risk profile remains positive.

In recent months, Johnson & Johnson’s vaccine has been linked to a small number of cases of blood clots in combination with low platelet counts. These cases, though small in number, were enough to draw international concern. The EMA made it clear on Tuesday that there is some validity to these links between Johnson & Johnson’s vaccine and blood clots. Moreover, in a press release, the EMA stated “that a warning about unusual blood clots with low blood platelets should be added to the product information for COVID-19 Vaccine Janssen.”

The EMA relied on all available evidence, it said, which included eight U.S. reports of serious blood clot cases. As of April 7th, more than 7 million people had received the J&J vaccine in the United States.

The linkage between the vaccine and blood clots is not unique to Johnson & Johnson. In March, more than a dozen European countries halted the use of the AstraZeneca shot after some people who received the vaccine reported experiences of blood clots. 18 of these cases turned out to be fatal, compared to only one case of fatality linked to the Johnson & Johnson shot. The EMA stated that “unusual blood clots with low platelets” should be listed as “very rare side effects” for the AstraZeneca vaccine.

On Friday, April 23rd, vaccine advisers to the Centers for Disease Control and Prevention will meet to make recommendations regarding the use of the Johnson & Johnson vaccine. They will be meeting less than two weeks after the CDC and US Food and Drug Administration recommended a pause on the use of the Janssen vaccine. The pause gave experts time to work with doctors regarding the identification and treatment of these rare blood clots.

Moreover, ranking members at the CDC project said that “there will likely be more reports of blood clots connected to the vaccine” (Mascarenhas, CNN). Dr. William Schaffner, a non-voting member of the CDC’s Advisory Committee on Immunization Practices, stated that he and his colleagues need to understand the demographics of blood clot cases before they can move forward with a decision. Dr. Schaffner said that on Friday, the ACIP could give the all-clear for the vaccine, or it could recommend that the US stop using the vaccine entirely. Dr. Schaffner thinks it is likely that the ACIP will recommend the use continues with warnings about possible adverse side effects. Additionally, Dr. Schaffner says it is wise for high-risk people to avoid the vaccine altogether.

The chair of the ACIP, Dr. Jose Romero, who is also Arkansas’ secretary of health, says that the committee has reviewed enough data at this point to make a responsible decision. Although more data will be presented on Friday, Dr. Romero believes that the committee will likely affirm the vaccine’s legitimacy after estimating the risk-benefit analysis. However, there are currently so few cases of blood clots that it is hard to assess the entire picture of risk. For example, all but one case were in females; some members of the ACIP are concerned that cases among men or older people might arise in the near future. The ACIP would benefit from more data in the form of blood clot cases, but those looking to receive the vaccine might not benefit.

Dr. Romero stated, “I really hope that the American public will look at this pause and look at what we have done during this pause as an indication of how safe the vaccine system and the vaccine pipeline is in this country.”

mclaughline7@lasalle.edu